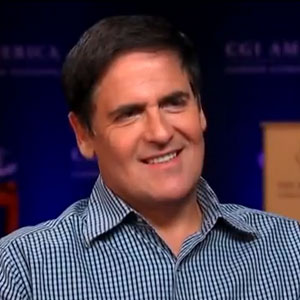

Mark Cuban Trial For Insider Trading Begins In Dallas

Mark Cuban, owner of the Dallas Mavericks and featured on ABC’s reality show Shark Tank began his trial for insider trading on Monday.

The trial has been in the works for over five years – the Securities and Exchange Commission (S.E.C.) filed a complaint against Cuban in 2008, alleging that, in 2004, Cuban had traded stock in a small Internet search engine company called Mamma.com after receiving confidential information from the company’s chief executive Guy Fuaré.

The S.E.C. claims Cuban, who then owned 6.3 percent of the company’s shares, was informed that the website “was planning a private offering of its stock" that would dillute Cuban's shares, reports The New York Times.

In a phone conversation between Cuban and Fuaré, the S.E.C. states that Cuban appeared “very upset and angry” over the phone and declared his displeasure at the fact that he would no longer be able to sell his shares after hearing private information. The suit also claims that Cuban promised to keep the information private and that he would not act on the information he received.

Later that night, June 28, 2004, Cuban reportedly sold 10,000 of his 600,000 shares in an after-hours trade. He sold his remaining shares the next day, saving him from losing approximately $750,000.

In 2009, the case was dismissed after a judge found that the S.E.C. had not adequately supported its claim that Cuban had agreed not to trade his shares based on the information he received from Fuaré. The case was reinstated one year later in a court of appeals. Now, three years after the case had been reinstated and nine years after the alleged 2004 transgression, Cuban’s case is going to court.

Cuban has maintained his innocence since the beginning of the S.E.C. case against him, and some speculate that he is entering trial to clear his name once and for all; Cuban is worth a reported $2.5 billion, and, if found guilty, he would have to pay a fine of around $2 million, according to The New York Times.

“I am excited about this, to finally come to court. I won’t be bullied. That’s the key element,” Cuban told reporters in front of the courthouse on Monday.

Cuban also expressed his excitement at being able to fire back at the S.E.C. in court, adding, “The think I am really looking forward to is shedding some sunlight on how the SEC really works.”

The S.E.C. reportedly obtained e-mail correspondence between Cuban and Fauré, though nowhere in the e-mails did Cuban or Fauré explicitly discuss any kind of confidentiality agreement or clause. Furthermore, it appears that the S.E.C. does not have a recording of the phone call between Fauré and Cuban in which Cuban allegedly declared his frustration at not being able to sell his shares.

Both sides shared their opening arguments to the jury today, Oct. 1, and the trial is set to continue through next week, at least. Cuban is expected to testify.

– Olivia Truffaut-Wong

Get Uinterview's FREE iPhone App For Daily News Updates here.

Get the FREE Uinterview iPad app here and watch our videos anywhere.

RELATED ARTICLES

Get the most-revealing celebrity conversations with the uInterview podcast!

Leave a comment